Tech leaks increase amid intensifying competition

By Nam Hyun-woo

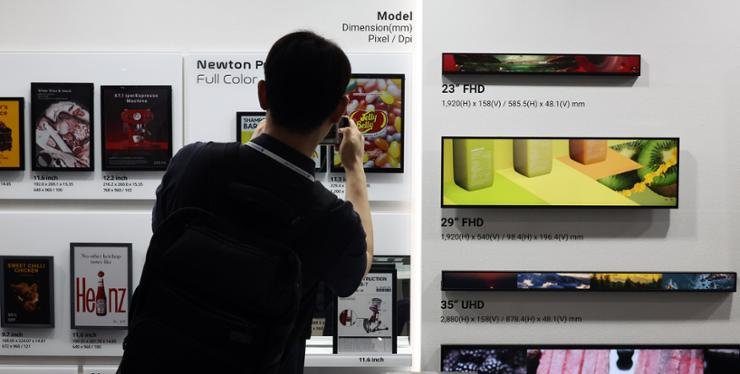

Korean companies’ dominance in the global display market is being increasingly challenged by their Chinese counterparts, with recent data revealing that Chinese firms’ global OLED market share surpassed that of Korean companies for the first time in the first quarter of this year.

Industry insiders attribute this shift to Beijing’s “patriotic consumption” campaign, which not only served as an informal boycott of imported products but also led Chinese smartphone manufacturers to favor OLEDs made by domestic producers.

Korean display makers such as Samsung Display and LG Display are striving to maintain their leadership in premium products by retaining their technological lead on Chinese players, but the competition is intensifying as evidenced by a growing number of tech leak cases.

Hot pursuit

According to data from market tracker Omdia, Chinese firms accounted for 49.7 percent of global OLED shipments in the first quarter of this year, surpassing Korean firms, which held 49 percent.

In the first quarter of last year, Korean and Chinese companies held market shares of 62.3 percent and 36.6 percent, respectively, maintaining a 25.7-percentage-point gap. However, this narrowed quickly to 9.5 percentage points three months later.

The gap widened to 14.9 percentage points in the third quarter and 16.7 percentage points in the fourth, but ended up being reversed in the January-to-March period this year.

In terms of OLED revenues, Korean firms are still maintaining a dominant market share with 62.8 percent in the first quarter of this year, with Chinese companies following with 36.4 percent.

This means that Samsung and LG still have their prowess in high-value products, but the revenue gap is also narrowing quickly, given that Korean and Chinese firms each accounted for 74.2 percent and 25.2 percent in the first quarter of last year.

Display industry officials attributed this trend to Chinese firms’ rise in OLEDs for smartphones, as Huawei, Xioami, Oppo and other Chinese smartphone makers increasingly use displays manufactured by their compatriots.

According to another market tracker Beijing Sino Research, Chinese display companies accounted for 50.7 percent of the global smartphone OLED market by shipment in the first half of this year, up 10.1 percentage points from a year earlier. During the same period, that of Korean companies declined to 49.3 percent from 59.4 percent.

Since China launched the “Made in China 2025” strategy in 2015, the country has been promoting its goal of improving the self-sufficiency of its industries, resulting in major smartphone manufacturers using domestically manufactured OLEDs in their new products.

According to data from the Korea Display Industry Association, 16 percent of smartphones made by Chinese makers used OLEDs manufactured by Korean companies last year, plunging from 77.9 percent in 2021 and 55.6 percent in 2022.

“After Chinese display makers claimed leadership in the LCD market, Korean firms have quickly lowered their reliance on LCDs and focused on OLEDs,” an industry official said. “Though Korean display makers maintain technological leadership for now, Chinese companies are in pursuit in terms of not only price competitiveness but also technologies.”

Technology war

Amid the intensifying competition, the number of trade secret leak cases is also rising.

According to the National Police Agency, police have investigated 12 cases of overseas technology leaks in the first half of this year, up from eight during the first half of last year. Among the 12 cases, three were related to the display industry.

On a yearly basis, police investigated only one leak of display technology in 2019, but the number grew to three in 2021 and 12 in 2023, showing that the competition is ever-intensifying.

In a recent case, the Seoul Central District Prosecutors’ Office indicted three former LG Display employees, including a former team leader, for violating the Act on Prevention of Divulgence and Protection of Industrial Technology and other related laws.

The indicted individuals face charges of allegedly photographing the blueprint of LG Display’s Guangzhou plant and providing them to a Chinese rival between 2021 and 2022. LG Display produces large OLEDs for TVs at this plant and has invested over 5 trillion won ($3.75 billion) to establish mass production facilities.

“While monitoring former employees, we have confirmed the circumstances that our technology has been leaked and requested law enforcement authorities to investigate,” an official at LG Display said.

“We are enhancing our security management and systems, and will thoroughly respond with legal actions to any attempts to leak our information, including industrial technology and other trade secrets.”

Last month, the Suwon District Court sentenced a former Samsung Display senior researcher to six years in prison for leaking OLED technologies.

The former researcher was indicted for attempting to leak technology related to OLED electronic circuit manufacturing equipment and inkjet equipment used to bond panels and cover glass to China from 2018 to 2020. The prosecution estimates that these trade secrets are valued at a minimum of 340 billion won.

The researcher’s five accomplices received prison sentences ranging from one to two years, but the researcher fled to China. After returning to Korea in May last year, the researcher was arrested by the prosecution in September.