Nvidia CEO hints at switching suppliers from TSMC

By Nam Hyun-woo

Samsung Electronics faces an urgent need to enhance its foundry manufacturing yield for artificial intelligence (AI) processors as Nvidia has suggested the possibility of moving orders away from Taiwan’s TSMC, citing sustained strong demand for its chipsets.

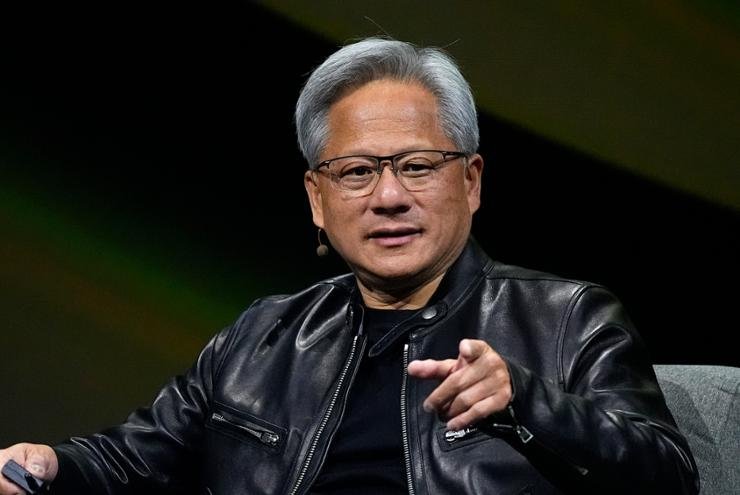

During a Goldman Sachs technology conference in San Francisco, Wednesday (local time), Nvidia CEO Jensen Huang told the audience that TSMC’s “agility and their capability to respond to our needs is just incredible,” but “if necessary, of course, we can always bring up others.”

Shrugging off concerns about AI chip demand, Huang said demand for Nvidia’s Blackwell chips is “so great,” and that Nvidia’s suppliers are doing their best to keep up with it.

At the same time, he noted that Nvidia could switch suppliers if necessary, due to concerns like rising geopolitical tensions in Taiwan. However, he warned that such a change might “result in lower-quality products.”

Nvidia is outsourcing the physical production of most of its advanced AI processors to the world’s largest foundry, TSMC, rather than to other foundries, including the second-largest, Samsung Electronics.

Last year, Samsung’s foundry secured Nvidia’s orders for 8-nanometer-based chips like the Tegra for automobiles and the RTX-3000 graphics processing unit (GPU) in 2020. However, it has not been successful in securing orders for more advanced AI processors, such as the H series or Blackwell, which require more advanced manufacturing processes.

The question, as Huang noted, is the quality. Samsung’s foundry is scrambling to improve its manufacturing yield, which refers to the ratio of good and error-free units to the total number of units produced. But the number is not improving as fast as Samsung hopes.

Samsung’s foundry struggled with a 3-nanometer process yield that remained in the single digits until the first quarter of this year, resulting in delays in supplying engineering samples for its own Exynos 2500 chipsets.

Domestic analysts assume that Samsung managed to improve the yield to nearly 20 percent in the second quarter, but this is still insufficient for mass production, which requires a yield of at least 60 percent.

Against this backdrop, Samsung appears to be struggling to secure foundry orders. According to industry officials, the company has recently adjusted its plans for installing equipment in its newest fab, P4 in Pyeongtaek, Gyeonggi Province, to prioritize the production of advanced DRAM memory, such as high-bandwidth memory (HBM) chips, first.

The fab was initially scheduled to start with equipment installation for NAND, followed by foundry and then DRAM products. However, this order has been altered due to sluggish foundry orders. There are rumors that Samsung may decide to use P4 exclusively for manufacturing memory chips, given the stable demand for high-bandwidth memory (HBM) and other advanced memory products used in AI servers.

In this context, Samsung’s investment in its plant in Taylor, Texas, is facing questions. The company initially planned to use the plant to mass produce 4-nanometer chips starting next year, but has postponed this plan until 2026. While the yield for the 4-nanometer process is reportedly stable, Samsung is struggling to secure orders from fabless companies.

As a result, there is also speculation that Samsung might shift its focus to 2-nanometer chips instead of 4-nanometer ones to secure orders for more advanced products in the future. However, reports indicate that the company is also facing challenges in improving the manufacturing yield for the 2-nanometer process, as well as the 3-nanometer process.

“One of the core reasons of Samsung foundry’s cumulative losses is the low yield,” a semiconductor industry official said. “The company managed to stabilize its yield for the 4-nanometer process, but has not done that yet in more advanced processes, such as second generation 3-nanometer or 2-nanometer processes.”

Samsung does not disclose the separate earnings of its foundry business, but market observers estimate that the company has incurred approximately 1.5 trillion won ($1.12 billion) in operating losses during the first half of this year.

“Samsung’s achievements in the HBM business still falls short of what should be expected from a brand like Samsung, and its foundry division is still struggling with losses,” Eugene Investment & Securities analyst Lee Seung-woo said. “As a result, the operating profit for Samsung’s semiconductor business in the third quarter of this year is expected to decline to 5.5 trillion won.”