Samsung Electronics said on Wednesday it will continue its earnings growth by expanding sales of the high-performance high bandwidth memory chip in the second half, particularly the fifth-generation HBM3E, to meet rising demand in the fast-growing artificial intelligence market.

“Customer evaluation of the 8-layer HBM3E product is currently in progress, and mass production supply is scheduled to begin in earnest in the third quarter,” Kim Jae-june, executive vice president in charge of memory marketing strategy, said in the second-quarter earnings call.

“The 12-layer HBM3E chip, which was developed and supplied samples for the first time in the industry, has already completed preparations for mass production ramp-up and will start supplies in the second half in line with the schedule requested by multiple customers.”

The company’s fourth-generation HBM3 chip has passed quality tests of US AI chip giant Nvidia and market analysts forecast that its latest HBM3E is expected to follow suit as early as next month. Kim, however, declined to elaborate on the ongoing test, excusing the non-disclosure agreement issue.

While its archrival SK hynix began supplying the 8-layer HBM3E product to Nvidia in March, Samsung is still undergoing quality tests for its HBM3E product. A day earlier, Bloomberg cited an anonymous source and reported that Samsung anticipates “approval for the next generation, HBM3E, in two to four months.”

With the performance recovery of the tech giant’s chip division due to the semiconductor upturn, there is an increased likelihood of the HBM3E becoming a “key player” in its chip business in the second half of this year, according to Kim’s forecast.

“The 12-layer HBM3 accounted for two-thirds of sales in the first half, prompting us to implement mature packaging in HBM3E. Based on this, the sales proportion of HBM3E within HBM is expected to exceed the mid-10 percent mark in the third quarter and expand to 60 percent in the fourth quarter,” he said.

As production capacity expands, the proportion of HBM sales in the second half is expected to be more than 3.5 times that of the first half. Kim also mentioned that next year’s HBM production is planned to be more than double that of this year.

He further hinted that Samsung’s sixth-generation HBM4 will be unveiled in the second half, while the company is working on customized HBM products to meet several customers’ requests.

At Wednesday’s second-quarter earnings call, Samsung also mentioned its largest labor union’s ongoing indefinite strike, saying that there are no issues with its production. “Even if the strike continues, we will do our best within the legal framework to ensure there are no disruptions to management and production,” a Samsung official said.

The National Samsung Electronics Union, which accounts for about 24 percent of Samsung’s total workforce, has held the strike for more than two weeks, demanding a 5.6 percent basic pay raise for all members, a guaranteed day off on the union’s founding day and compensation for economic losses due to the strike. The unionized workers and the management recently resumed talks.

Before Wednesday’s earnings call, the tech giant released reports on the April-June period, before the Korea Exchange opened.

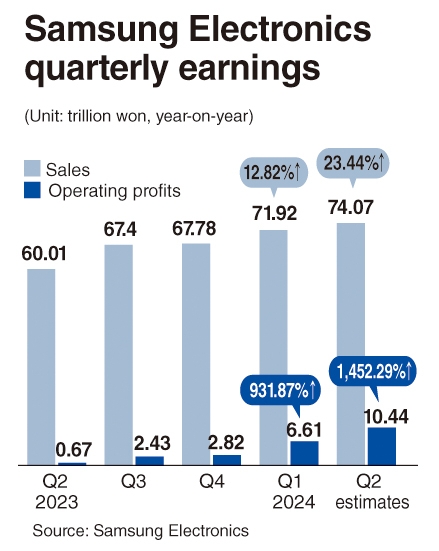

Samsung said its second-quarter operating profit jumped about 15 times from a year ago, mainly attributable to the robust performance of its semiconductor business. Its operating profit came to 10.44 trillion won ($7.57 billion) for the three months through June, up 1,462 percent from a year ago.

It is the first time the tech giant has posted an operating profit of above 10 trillion won since the third quarter of 2022 when it logged 10.8 trillion won. It is also above its figure for last year — 6.5 trillion won.

Sales added 23.4 percent on-year to 74.06 trillion won and net profit soared 471 percent to 9.84 trillion won.

Samsung said it invested 8.05 trillion won in research and development in the April-June period. Of 12.1 trillion won in facility investment spending, it invested 9.9 trillion won in the chip sector.

By segment, Samsung said its chip business posted an operating profit of 6.45 trillion won with 28.6 trillion won in sales. It successfully turned into a surplus for the first time in five quarters since the first quarter of 2023, thanks to increasing demand for memory chips.

The foundry business saw improved earnings in the second quarter due to increased demand across applications.

The mobile business’ operating profit and sales came to 2.72 trillion won and 42.07 trillion won, respectively, backed by waning demand for smartphones.

Due to global sporting events, including the 2024 Paris Summer Olympics, the TV business expanded, while the home appliance segment saw a gradual recovery on rising demand for new products, the company said.